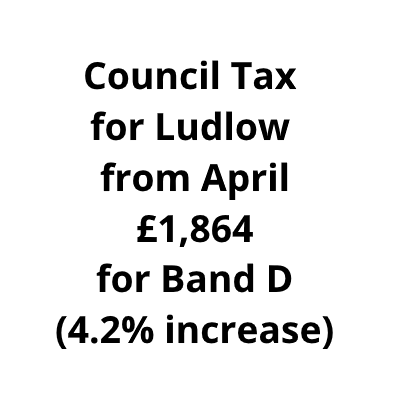

Next Thursday, Shropshire Council will vote to raise council tax by 3.99%, the maximum allowed without holding a referendum. This will take the payment for a Band D property to £1,388.23. There will be a rise of nearly 10% in the police precept and 4% in the fire precept. Most parish and town council precepts will rise, though not in Ludlow where the precept has risen by 48% since April 2017. Overall, Ludlow residents will see their combined council tax and precept bill rise by 4.2%.

Setting council tax is an annual ritual and an essential part of a councillor’s duties. Not all councillors will vote for the increase at full council on Thursday but I have no doubt the tax rise will be passed. It may seem strange that council tax is rising at a time when local services are being cut. But the cost of providing adult social care is rising and government grants are falling. Local tax payers end up paying more for less.

This rise will hit those on the breadline, especially as Shropshire Council cruelly removed the 20% discount given to people on benefits. Others may feel it is worth paying the price to keep at least some services intact.

There are 14 town councils in Shropshire. Ludlow is not the most expensive. Bishop’s Castle charges a higher precept. But it is striking how little precept is charged in Shrewsbury. It has the benefit of having the largest number of households paying council tax, 24,566, compared to 647 in Bishop’s Castle and 3,501 in Ludlow. It can even afford to spend money on a personal chauffer for the Mayor of Shrewsbury.

Bromfield parish council will increase its parish precept from £17 to £32. Ludford goes up from £16 to £19. Full list of parish precepts.

It’s worth clarifying a few points about the way that local authorities are funded.

Capital budgets are different from revenue budgets. That means that Shropshire Council can buy two shopping centres from its capital reserves even when it is struggling to fund basic services. The council believes that it will make money from the shopping centres which will be ploughed back into services. I don’t believe that but I’d love to be proved wrong. Councils can also borrow money for capital projects, currently at around 2.5% interest but they can’t borrow to fund services.

Councils do not set business rates. Business rate policy is set by the government and the rateable values of individual businesses are set by the government’s Valuation Office Agency. Shropshire Council receives around 50% of the business rates collected in the county. From 2020/21, it will receive 75% of business rates but also get less government grant. That’s as clear as mud at the moment and we don’t know whether Shropshire Council will be better or worse off.

Interesting, does the police addition rise mean we may get more police?

When I was hitin the face by a junkie it took 999 25 minutes to arrive,had I been attaked by the man if he was armed with aknifeI would be dead.

It’s only a matter of time given the way we have no Ambulance, No police station in Ludlow until we have a knife murder and the person will die due to lack of abilitty to respond.

A policeman blew the whistle on Shropshire active responders and got reprimandedfor telling the truth that most times only 7 police are available county wide..

And the mayor of Shrewsbury has a chauffer….says it all….

Thankyou for explaining the numbers Bodders……appreciated..