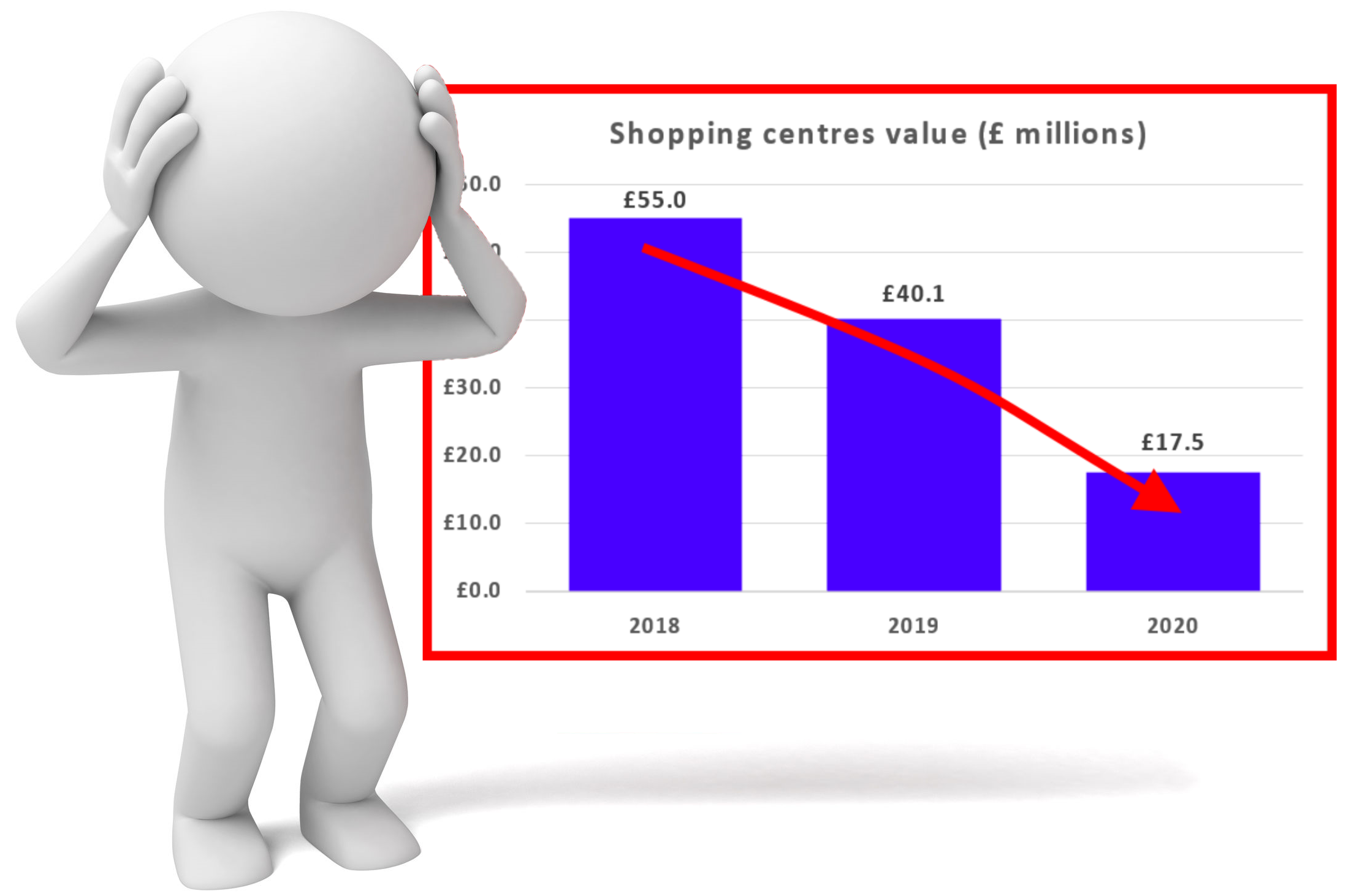

The devaluation of the Pride Hill, Darwin and now defunct Riverside shopping centres within the Shrewsbury Loop will be a surprise to no one. But the collapse in value from £51m to £17.5m– 66 per cent – over three years is bigger than expected. It is one of the biggest, if not the biggest, retail devaluation seen anywhere in England in such a short period.

Shropshire Council has shrugged this off as an expected devaluation. Deputy Council leader Steve Charmley said:

“We were aware of the possible downturn in the fortunes of the high street – an issue compounded by COVID-19 – but it’s for exactly that reason that the purchase was made – so that we could manage and mitigate any downturn.”

The Shrewsbury shopping centres are expected to provide a profit to council tax payers of just £434,000 this financial year. Less than one per cent return on the original investment. The council could have better spent our money on social housing.

The fall between the 2019 and 2020 valuations was 56%, £22.6 million. To provide a comparison, over the same period retail property giant British Land wrote off 26% of the value of its retail portfolio. Losing a quarter of the value of a retail portfolio is a misfortune for shareholders. Losing more than half the value looks like carelessness. A careless regard for Shropshire Council’s shareholders, us council tax payers,

This is not a book loss. It is not, as some commentators have said, irrelevant until (if) Shropshire Council sells the shopping centres. More than £50 million has been locked up in this venture when it could have been better spent on a long term investment. Desperately needed social housing would provide a steady and guaranteed return that would not be subject to the maelstrom of the high street retail economy.

By way of examples. INTU is in administration. John Lewis has closed its flagship store at Grand Central, Birmingham. Houses of Fraser. Debenhams. Boots. The list of chains closing stores and chains closing altogether seems unstoppable.

Nationally, according to the Financial Times, only 14% of retail rents were paid by Midsummer Quarter Day 2020. Only 20% of rent payments had been banked by landlords in the previous quarter. On top of this, retailers are being offered significant rent reductions by landlords who are desperate to avoid vacant retail units.

It is in that cntext that around £609,000 in rent reductions have been agreed for the Shrewsbury shopping centres. After some reduction in operational costs, the income to the council is expected to be £434,000 for 2019/20. That’s less than a one per cent return on the £51 million investment.

A huge investment is needed to turn the sprawling and struggling retail centres. There are no estimates yet but £6 million was provisionally set aside for works.

There has been some refurbishment of the shopping centres. The arrival of Primark is welcome (but I wonder whether it has been paying a market rent). Riverside is to be demolished soon. But we still have no plans for the future of the 16-hectare shopping complex. We still have no idea how the unpublished plans for the future of the shopping centres estate will be funded. We have no idea how Shropshire Council will ‘manage and mitigate’ any downturn.

But we do know it will involve more council taxpayers’ money.

Shropshire Council could have worked in partnership, as many other councils wisely do, with a developer to regenerate the now outdated shopping centres. But it chose not to, believing councillors and officers could do better than those with decades of experience in large scale retail. Most of those with that experience were disinvesting years ago.

Well they would shrug off the loss wouldn’t they. It’s not their loss it’s ours!

So much for ‘The Party for Business”. Funny business more like.

A few months before this woeful decision was taken I went to the Shropshire Pension Fund meeting at which a property representative explained how the pension fund was getting out of city centres and investing instead in big distribution warehouses used by mail order firms. It was a deeply persuasive and very reassuring presentation.

Then came the news that Legal & General had got out of city retail property in SHREWSBURY…they really saw these councillors coming. What happened to the five percent return they talked about at the time? And what will happen now as those retailers left decide either to pull out or negotiate an even lower rent?

Since it became a unitary Council, Shropshire has made one dreadfully reckless financial decision after another. We are run by small shopkeepers who think they are investment giants and have pretty much reduced everywhere but Shrewsbury to the status of rural rust belt. And in the teeth of this knowledge, the rural poor turn out and vote them back in or don’t even bother to put up candidates against the Tories.

My council tax is now my highest monthly expense and I get no services worth speaking of as a result. It really doesn’t have to be like this; but demoralised people don’t vote- and those in power have a vested interest in keeping the electorate uninformed, uninterested, unthinking and unengaged.

If it weren’t for these blogs of yours, I would have no idea what was happening in the Council. So thank you for performing this public service. I live outside Stretton, so I can’t even vote for you..