Last year, the government revalued all 1.96 million non-domestic properties in England and Wales.[1] In England, rateable values will be increased by an average of 10% from 1 April 2017. Across Shropshire, they are going up 13%. And here in Ludlow rateable values are going up by an eyewatering 37%, nearly four times the national average.[2]

This does not bode well for the future of local businesses, though in the short term there is more good news than bad. Over the next five years increases in business rates will be reduced by a complex series of reliefs and changes to the way that business rates are calculated.[3]

In the year from April, Ludlow businesses will pay a total of £300,000 less in business rates compared to this year. Nearly 400 businesses will pay no rates at all over the next five years. It’s not such good news for the 200 businesses that do pay rates. By 2021/22, they will be paying £385,000 extra, an increase of 11%.[4] Most of these businesses are in the vital retail sector.

Business rates are a tax based on property rental values. They raise £28 billion a year, split equally between the treasury and local authorities. That’s the plus side for public finances. The downside is that business rates are the third largest outgoing for local firms after staff and rent.

Ludlow’s business rates

Increase in rateable values by geography

Business rates are notionally paid by all companies operating from a business property. Whether a business will pay at all and the amount it will pay will depend on the rateable value for the property it occupies,[5] as well as a rather complicated range of reliefs.[6] I have modelled these for the 596 businesses in Ludlow and Ludford that work from premises.[7] In 2016/17, these businesses have paid an estimated £3,654,000 in business rates.[8] By April 2021, this will be paying around £4,038,000 a year.

There is some good news from the new business rates regime. In 2016/17, 47% of Ludlow businesses were exempt from business rates under the government’s small business rate relief scheme. From April, that will rise to 66% of businesses in our town (394 companies). These local companies would have paid an estimated £1,287,000 in 2017/18 if they had to pay rates.[9]

That’s not all the good news. On average, the total business rates paid by industrial firms in Ludlow will fall by 13% from April. The rates will then increase but will still be 2% lower in 2021/22. There is a similar pattern for offices, which see a 19% drop next year and will be 3% lower in 2021/22.

Across all sectors, Ludlow businesses will pay around £304,000 less in business rates in 2017/18 compared to this financial year. But by 2021/22, they will be paying around £385,000 more.[10] Most of this increase (77%) will fall to the retail sector.

The remainder of this article concentrates on the implications for retailers.

The retail sector

Number of Ludlow and Ludford businesses by sector[11]

Ludlow, as we know, is heavily dependent on its retail sector. We have at least 257 retail businesses, 43% of rateable businesses in the town.[12] These businesses are facing an average 39% increase in rateable values this year.

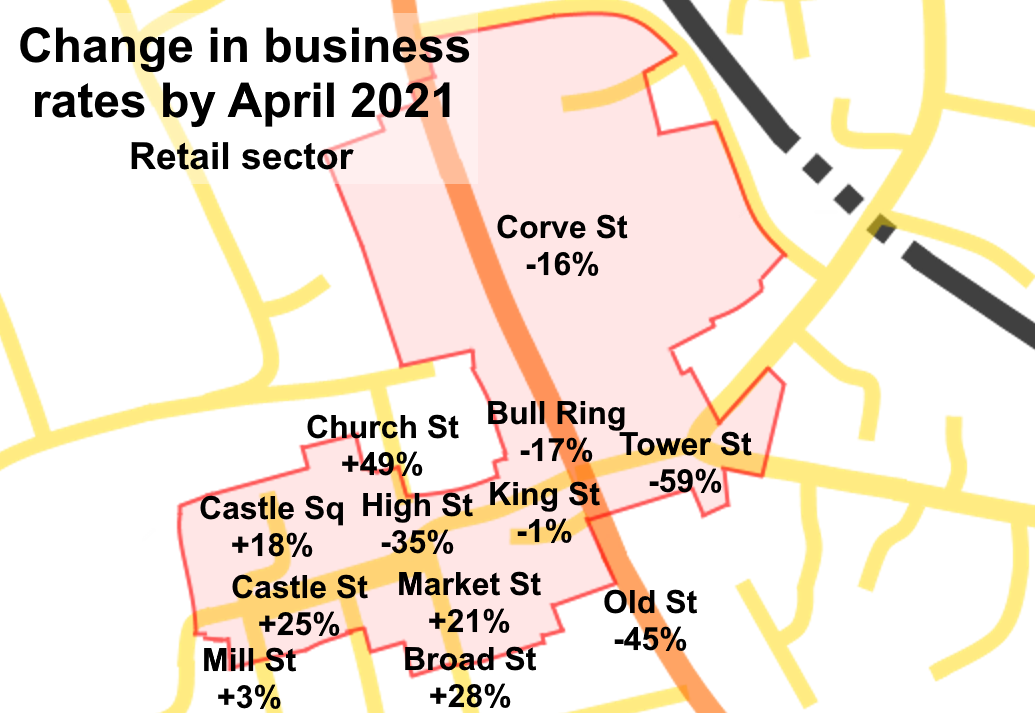

The map below show the changes in rateable values for retail premises on key streets in the town centre area (shown in pink).[13]

From April, 149 retail businesses will not pay business rates, up from 87 firms this year. That will save retailers more than half a million pounds (£509,000) in 2017/18. Hairdressers, small cafes, butchers and bakers, and purveyors of delicious cheese and fine wine will benefit from paying no business rates at all. Two in three local retail businesses will pay no rates, compared to just two out of five national retailers operating in the town.[14] Because a lot of our small businesses have been exempted from rates, the overall business rate levy has plummeted on some streets in the town centre, as the map below shows.

That’s the good news and it will help many of our town’s smaller independent traders.

It’s not looking as rosy for the 108 retail businesses that will pay business rates in 2017/18. Estimates suggest they will be paying a total of £2,332,000 business rates in five years’ time. That’s an increase of £543,000 or 23%.

Local retailers will be hit disproportionately, facing a 27% rise in business rates by 2021/22. National retailers operating in Ludlow will see a 21% rise.

This disparity partly arises because many of our signature local retailers are in prime locations where rateable values have soared. On Church Street, rateable values will increase by 74%. Castle Street will be up 50%, Castle Square 51% and Broad Street 61%. Elsewhere in the town centre, increases will average around 30%. These increases reflect rising rents on our town centre.

The other main factor is that rateable values for the town’s pubs have soared by 77%.[15]

Retails businesses that face an increase in business rates by 2021/22 approaching 150% are the Charlton Arms, Cliff Hotel, Pets at Home and The Queens.[16] Nearly 50 other businesses will see increases of above 50% over the next five years (31 local businesses; 17 national). These include stores that create the unique character of our town centre. Bodenhams, Harp Lane Deli, Castle Book Shop and Country Linens. Bebb Fine Arts, Ginger Antiques, The Fruit Basket and Ludlow Interiors. Broad Bean, Aragons, Valentyne Dawes Gallery, Poyners, and Walton and Price’s Bakers. And many others.

Looking ahead

The government has said: “The majority of businesses across the country will be unaffected or better off by the changes.”[17] That’s certainly the case in Ludlow where 69% of businesses will be paying the same or lower business rates in 2021/22 than now. But 31% of businesses will see a in payments, including 42% of retail businesses.

This rates revaluation has caught many of our local businesses by surprise. The revaluation means that central Ludlow will become a more expensive place to do business in the coming years. That can’t be good for our town.

I fear the business rate rises over next five years will have a disproportionate impact on our distinctive local shops. The national and multinational stores will weather the storm. But independent businesses do not have the margins to absorb such large increases in rates. This increase will eat away at their profits and some businesses will fold. This would change the unique character of Ludlow’s town centre and we could end up a clone town like so many others.

At least now we have a basic idea of the level of business rates in Ludlow for the next five years. We have no clue what will happen after April 2022.

In October 2015, the then chancellor George Osborne announced that from 2020 all the money raised by business rates will be kept by local councils, not 50% as at present. This is not a gift. The Treasury is currently phasing out the revenue support grant which is the mainstay of council funding alongside local council tax. From 2020, the grant will have ended and it is the government’s intention that the majority of council’s income will be from council tax and business rates.

This change could mean less interference by national government in local affairs. But it creates problems for counties like Shropshire. We have more small businesses than many areas and most of these will not now pay business rates.[18] We have an elderly population, which brings with it higher social care and support costs. This is going to create a significant funding gap for Shropshire after 2020. We do not yet know the rules for the business rate transfer but unless business rate income is topped up in some way, our county will be facing a massive shortfall in income.

By 2021/22, businesses of all sizes will have paid reduced business rates due to eleven years of transitional relief. Millions of small businesses will have paid no business rates at all. This means that there is a widening gulf between rateable values and the rates paid, which makes the whole rates system a bit of a nonsense. There have been many calls over the years for business rate reform. The government needs to bring forward plans before 2020 to reform the system and to plug the funding gap counties like Shropshire will face.

Example of how rate increases work

Take a business property with a 2010 rateable value of £14,700, the average for Ludlow and Ludford before revaluation. The business rates in 2016/17 would be £7,115.

The business rate is calculated by multiplying the rateable value by the annual multiplier. In 2016/17, the multiplier was 48.4p in the pound for small business. This gives a business rate of £7,115 for a property with a rateable value of £14,700, less any outstanding transitional relief.

Assume now that the rateable value has been increased to £18,230 from April 2017. This will be the average for Ludlow and Ludford after revaluation. The business rates payable before relief will be £8,495. That’s an increase of 32%.

The multiplier for small businesses for 2017/18 is set at 46.6p in the pound.

For small businesses with a rateable value of £20,000 or under, the increase in the first year is capped at 5% rising to 15% in year five. In practice, many businesses will receive transitional relief for fewer than five years.

The table below shows the costs for our average Ludlow property, which would receive £1,659 in transitional relief over three years.[19] Taking this relief into account, the business will need to pay an additional £6,973 in business rates over the next five years.

Notes

[1]. House of Commons Library: Business rates: the 2017 revaluation. Over the last two years, the Valuation Office has revalued 1.96 million business properties across the country. This has led to huge hikes in business rates in the south of the country, especially London, and drops in rates in the north of England. The revaluation had been due to take effect from April 2015. The government delayed the process to 2017, citing the state of the economy. Some thought that the delay was to avoid businesses in the south of England facing large rate rises just before the 2015 general election. Legislation prevents the government from raising extra funds from a revaluation.

[2]. This article is based on information available in December 2016. Final details of rateable values and reliefs will be confirmed by 1 March 2017. Ludlow in this article includes the parish of Ludford, which is where the Foldgate retail area and Eco Park are located.

[3]. Formally, business rates are known as the National Non-Domestic Rates (NNDR). The rate is payable by all businesses unless exemptions apply. See House of Commons Library, Business Rates, April 2016. Rateable values for individual businesses can be looked up here.

[4]. Business rates are calculated by multiplying the rateable value by a national multiplier. The government intends to reduce the small business non-domestic multiplier for 2017/18 from 48.4p to 46.6p. The national non-domestic multiplier for businesses with a rateable value of more than £18,000 will fall from 49.7p to 47.9p. The multiplier rises annually but by no more than the retail price index. For this article, I have assumed it will rise at 2% annually. See Consultation outcome: Business rates revaluation 2017.

[5]. Rateable values for business properties are based on the rental value of properties on 1 April 2015 (see How non-domestic (business) properties are valued). Rateable values for most retail premises are calculated on rental value based on a zoning scheme (see Business rates: how different properties are measured). This zoning method puts emphasis on shop windows, raising the rateable value for high street properties with wide shopfronts. Holiday properties available to let for 140 days or more per year are treated as self-catering properties and valued for business rates (see Self-catering and holiday let accommodation). The rateable value for pubs is calculated on the basis of “fair maintainable turnover” (see Valuation of public houses). The annual rise, or decrease, in business rates for any one premises, is capped under the transitional relief scheme. For details see Consultation outcome: Business rates revaluation 2017.

[6]. There are a range of reliefs that reduce business rates payable. Small businesses with a rateable value of under £12,000 pay no business rates from April 2017. Those with a valuation of under £15,000 will pay a reduced rate. Transitional relief also applies (see Note 5). Seven Ludlow charity shops, the Assembly Rooms and the Leisure Centre get 100% relief.

[7]. This is not the total number of businesses in Ludlow. Many small businesses will operate out of home or share offices. In this article, “businesses” refers to enterprises working in buildings that have a rateable value.

[8]. In calculating this estimate, I have assumed that no transitional relief is in place. In practice, some companies may still be benefiting from the previous transitional relief scheme and the total business rate bill may be lower.

[9]. In 2016/17, small businesses with a rateable value of £6,000 or less paid no business rates. Those with rateable values of less than £12,000 paid a reduced rate. See Note 6 for reliefs from 1 April 2017.

[10]. Here are the rateable values for the big ten businesses in town. Tesco: £650,000; McConnel: £252,500; Budgens: £206,000; Aldi: £206,000; Midcounties Co-operative: £145,000; The Squirrel: £123,000; Severn Trent Water: £98,500; Spencer Manufacturing: £95,000; NHS Property Services, Ludlow Hospital: £92,000; DMS Plastics Limited: £78,000.

[11]. Source: my classification of properties with rateable value. My definition of retail includes food outlets, restaurants, pubs and hairdressers (in planning terms, it is use classes A1-A5). The leisure sector is largely sports grounds, holiday lets and guest houses. Ludlow has 35 self-catering holiday lets.

[12]. UK business; activity, size and location: 2016 suggests that 7.5% of businesses in the UK are in the retail sector. The national data underestimate the number of small retailers as many will not use PAYE or pay VAT.

[13]. Town centre as defined in the local plan, SAMDev. The increase in rateable values is for the entire street, not just the part in the town centre area.

[14]. 118 of 184 local businesses will not pay business rates in 2017/18; 11 of 49 national businesses are in the same position. Not all businesses could be classified as local or national.

[15]. Pubs are treated as local businesses in my analysis. Although several are owned by national companies, they are run as a local enterprise. I make an exception for the Squirrel, which is run as part of a national operation.

[16]. Businesses can appeal their valuation, so these details may change.

[17]. Consultation outcome: Business rates revaluation 2017.

[18]. 22% of our enterprises have turnover of under £50,000 a year, 4% higher than the average for England. Only 7% of our businesses had a turnover of at least £1 million, compared to 9% for England. Source: UKBF01 Enterprise by Turnover size band and GB Local Authority Districts, December 2015. 77% of Shropshire enterprises have fewer than 5 employees compared to 70% across England. Source: UKBD01 Enterprise/local units by Employment size band.

[19]. Assumes 2% annual increase in the multiplier.