In Brief

Blackfriars Developments has submitted an outline application for a 25,000 sq ft supermarket and an accompanying petrol station on the outskirts of town at Rocks Green (further details).

Indigo Planning, acting for Blackfriars, says that the supermarket will draw 6% of trade in food and other convenience goods away from the town centre in 2019. That’s £700,000 a year. Town centre traders will lose a further £450,000 in comparison goods.

Tesco and Aldi are set to lose nearly one-third of their turnover in convenience goods if the new store is built.

Rolling together the loss to town centre traders and the two supermarkets, the central area of Ludlow is set to lose one quarter of its retail expenditure if the new supermarket is built: £12.6 million on a £50 million annual turnover.

Indigo says that the opening of Tesco has not affected town centre retailers and neither will the new supermarket:

The introduction of a new supermarket in the town will not affect the success of the town centre… The impact of a new foodstore at Rocks Green will be significantly less than the impact of Tesco opening… Those who shop in the town centre will continue to shop there, and tourists who visit Ludlow will still continue to visit.

What turnover will the new store have?

Indigo say the planned store will have an estimated £26 million turnover.[1] £14 million of this will be drawn from existing stores in the area, especially Tesco and Aldi.[2] Another £3.5 million will be drawn from stores from further afield, mainly Leominster, Shrewsbury and Kidderminster. Indigo doesn’t say where remaining £8.5 million will come from but presumably much of the spending will be from people who live beyond the Ludlow area.

The proposed foodstore will mainly cater for bulk weekly, fortnightly or monthly grocery shopping needs, usually collected by car.[3] These are known as convenience goods.

£4.5 of the £26 million spending in the new store will be on comparison goods, things like electrical items and clothing

(See the jargon buster for an explanation of convenience and comparison goods.)

Impact on the town centre: the convenience trade

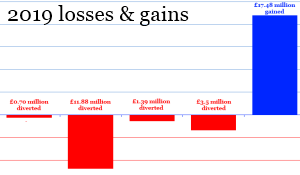

Estimated diversion of trade from existing stores to Rocks Green in 2019

Estimated diversion of trade from existing stores to Rocks Green in 2019

In 2019, Rocks Green is expected to take £520,000 from the turnover of local stores in Ludlow town centre each year (6% of their £8.2 million annual turnover).[4] The local stores include Spar and the Tower Street One Stop, as well as our independent retailers. The new supermarket will also draw an estimated 6% from the Tower Street Co-op (£170,000 from a £3.1 million turnover). So, using the developers’ definition of the town centre, 6% of retail turnover will be lost in 2019 to the new store.

The impact on Tesco and Aldi, both of which the developer regards as being outside of the town centre,[5] is expected to be much greater:

- Tesco will lose 28% of its £22.5 million turnover

- Aldi will lose even more, £35% on a £16 million turnover.

If built, the supermarket convenience trade at our two biggest stores will fall by nearly a third (31%).

Most people who live in and around Ludlow regard Tesco and Aldi as being in the town centre. These two stores account for 90% of the main food turnover in Ludlow and 77% of the total convenience expenditure.[6] If we include these two stores, the central area of Ludlow will lose one quarter of its convenience expenditure. That’s £12.6 million on a £50 million annual turnover (25%).

Impact on town centre: the comparison trade

The Rocks Green store will also sell comparison goods – cloths, electrical items and so on. The developers estimate that Ludlow town centre will lose £450,000 on a comparison goods turnover of £39 million in 2019 (1%). Again this estimate does not include Tesco and Aldi.

Impact on town centre: total trade impact

Combining convenience and comparison spending, the Indigo Planning concludes the town centre will lose 2.3% of its turnover in 2019: £1.1 million on a £51 million turnover.[7] This excludes Tesco and Aldi.

The impact of Tesco and Aldi on the town centre

Indigo say our current supermarkets complement other retailers in the town centre.

Many people make ‘linked trips’, that is they visit other retailers before or after doing their main shop. More than half of shoppers at Tesco shop elsewhere alongside their main shop (21% say they always do this; 34% sometimes).[8] Nearly as many shoppers at Aldi do the same (22% always; 31% sometimes). Linked trips from the Co-op are, as might be expected, much higher (27%; 43%), as are linked trips from local stores in the town centre (32%; 41%).

People who make their main food shop in Ludlow also say they regular visit the town centre for shopping. Almost everyone who does their main shop at Tesco also visits the town centre at least a month for one reason or another (99%; 44% visit at least once a week).[9] Shoppers at Aldi behave much the same (97%; 40%).

Will the new supermarket reduce footfall in the town centre?

If people can do their main shop outside the town, will they still come into the town centre to use the shops and cafés? We have seen that trade to Tesco and Aldi will fall by nearly one third and that half of the people shopping at these stores also do linked trips to the local shops and market.

Indigo says that the “impact on linked trips will be limited”.[10] The company uses a number of arguments to support this claim, including that the new store will not replace visits to services, such as the hairdressers, post office, bank or doctor.[11] Indigo says that people who objected to Tesco and Aldi said it would have a detrimental impact on the town centre, but that impact has not materialised:[12]

Since opening both the Tesco and Aldi stores have not had the materially harmful impact on the town centre that was perceived. Ludlow has continued to trade positively and remains both vital and viable.[13]

Impact on the town centre: conclusion

Indigo says the town centre is prospering, partly due to tourists who continue to visit Ludlow for its unique food and drink offer.

The introduction of a new supermarket in the town will not affect the success of the town centre in this regard… Similarly, residents who frequent Ludlow market, which has been operating on the same site for 900 years, and who visit the local smaller independent retailers, will continue to shop there. Their shopping patterns will not change with the introduction of an additional supermarket. The retail offer within the town centre is wholly different to that proposed by this development.[14]

The impact of a new foodstore at Rocks Green will be significantly less than the impact of Tesco opening.[15]

Those who shop in the town centre will continue to shop there, and tourists who visit Ludlow will still continue to visit. This will not change.[16]

About this article

The information in this article is taken from the Planning and Retail Statement (PRS) submitted by Indigo Planning with the application (14/05573/OUT). It does not represent my views and I remain neutral on the application as a member of the South Planning Committee.

Indigo Planning is clear that many of the figures in their report are estimates. They say:

Trade diversion estimates are always based on professional judgement and experience. There can be no evidence of what might happen. However, these judgements are informed.[17]

You may find it helpful to refer to my retail jargon buster. In another article, I set out the main planning rules that apply to developments like this.

Notes

In the title of this blog “everyday trade” refers to convenience trade.

[1]. Planning and Retail Statement (PRS) Table 9 & 10.

[2]. Ludlow area: this is the Study Area used by Indigo Planning for the PRS (map).

[3]. PRS 6.3.

[4]. PRS Table 10.

[5]. I do not agree with Indigo Planning that Tesco is edge of centre and that Aldi is out of centre. My reading of the planning documents is that Tesco is inside the centre and Aldi is edge of centre (see The Planning Context). I have asked Indigo Planning to clarify their statement. In any event, the definition of the town centre is for planning purposes, it does not define how people shop.

[6]. PRS 6.9.

[7]. PRS Table 15.

[8]. PRS 6.18; Table 6.7. Indigo Planning commissioned a survey of 1,000 people in a broad area in and around Ludlow (map).

[9]. PRS 6.15; Table 6.6.

[10]. PRS 8.55.

[11]. PRS 8.54.

[12]. PRS 9.21-9.28.

[13]. PRS 9.23.

[14]. PRS 9.31.

[15]. PRS 9.34.

[16]. PRS 10.6.

[17]. PRS 8.26.