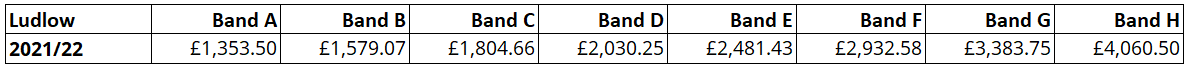

It’s that time of the year again. This morning, Shropshire Council agreed to council tax rises for the next financial year. Band D households in Ludlow will pay £2,030.25, up from £1,945.34 this year – a rise of 4.4%.

Council tax has four components. By far the largest is Shropshire Council’s charge, which is 74% of your council tax bill. The police commissioner takes 12%, Ludlow Town Council 9% and fire and rescue 5%.

Most of Ludlow’s expansion will be in Ludford parish which charges just £32.78 as its parish precept. The Ludford Question can only be resolved by merging Ludford and Ludlow into a single council. That could lead to an additional £90,000 income a year from the combined parish precept once the planned new housing is built.

Of this Band D charge, £184.64 will go to pay Ludlow Town Council’s precept. That’s up 6% from £174.27 this year. Shropshire & Wrekin Fire Authority will receive £104.20 for a Band D property, up £2% from £102.25 this year. The West Mercia Police & Crime Commissioner’s charge is £240.19, up 7% from £225.20.

The overall increase has been kept down after a decision by Shropshire Council leader Peter Nutting to raid reserves, something he has usually argued against, to keep the unitary authority’s share of the tax rise to 3.99% rather than the maximum allowed of 4.99%. Unless there is a revolution in the way that local councils are funded the council will need to add the 1% reduction to next year’s increase to fund the soaring costs of adult social care.

Few people want to pay more tax than they have too. The 3.99% rise will not be welcomed but people will accept it is better than 4.99%.

There are local elections in May and it helps to keep local taxes down.

Shropshire Council’s budget next year will be £554.3m, more than half of which is allocated to education and other matters and cannot be used flexibly by the council. It will have £208.6m to spend on everything from roads to looked after children and adult social care.

Ludlow Town Council now has the third highest precept among Shropshire’s market towns. It has had reduced income this year mostly due to reduced activity on the market.

Almost all of Ludlow’s development will be in Ludford Parish which has increased its precept from £24.67 to £32.78. Despite the 33% hike, residents in Ludford pay under a fifth of the precept that residents in the Ludlow Town Council area pay. This is known as the Ludford Question.

Market towns across the county are having to build housing in adjacent parishes to meet their needs, along with Shropshire Council and government targets. But those parishes do not contribute to their market town’s resources. Several market towns have begun to discuss this problem, including Oswestry and Bridgnorth. But there has been no discussion at Ludlow Town Council despite it being a pressing issue.

If Ludlow and Ludford were merged, an extra £90,000 extra income could be raised once developments are completed in Ludford Parish. Taxes are never popular but neither is a decline in services. It would be wrong if expansion of our town is at the expense of the financial viability of our civic services. It would be wrong if people moving into Ludford did not contribute their share to supporting the viability of our town.

The extra income need not go towards services, it could be used to reduce the precept for Ludlow residents by around £25. Or a mix of using money for services and reducing the precept. As with the merger of the district councils to form the unitary council there is likely to be a transitional period with year by year adjustment of what people pay. Low income households can apply for a council tax reduction of up to 100%.

This is a pressing issue not just because of the inequity that exists between the precepts paid in market towns and the much lower council tax rates paid by households moving into new housing estates in the parish that adjoin the longstanding town council perimeter.

A review of parish and town council boundaries will be launched by Shropshire Council in May. This is likely to recommend significant changes to boundaries due to the rate of greenfield housing growth across Shropshire. Any changes will come into force in time for the May 2025 elections. Let the debate begin.

Why are Ludlow residents always seen as cash cows. Shropshire council and Ludford Parish are taking advantage. Any services that Ludlow Town council fund should be chargable to anyone who is not a Ludlow resident.

I suppose the residents of Ludford will look forward to seeing a massive hike in Council tax in the event of combining Ludford and Town parishes. Does that mean the original hamlet properties will have mains gas and mains drainage installed? Probably not…

Utilities are not a council responsibility so you can’t expect any action on that.

Surely Shropshire Planning is part of the Council paid for in part by our Council tax. Why therefore, if they expect to penalize us in Ludford by increasing substantially the precept, did they not make it a condition of Planning consent that mains drainage (and maybe gas) should be routed down the A4117 so that the original residents could also benefit?