As I reported yesterday, council tax for Ludlow residents will increase by 4.3%. A Band D property will pay £1,945.34. But where does this money go?

Fire and Rescue receives £102.25, West Mercia Police £225.20 and Ludlow Town Council £174.27. That leaves £1443.62 for Shropshire Council. The only available detailed breakdown for where this money goes is from last year’s account. This article is therefore based on 2019/20 council tax using data for Band D properties.

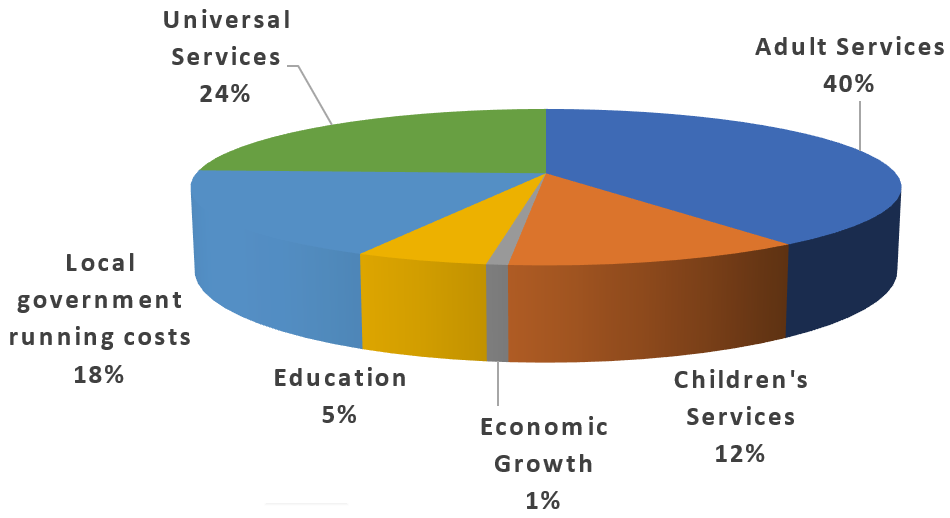

Half of your council tax bill, £805.12, last year went to adult and children’s services, mostly social care. Waste and recycling services cost you £188.01. Council operating costs were £285.89.

Council budgets are complex and I do not aim to give a full overview in this article. I concentrate on where your council tax goes.

This is not the total budget for each area. Government grants and the council’s 48% share of business rates top up the money from council tax. Schools and colleges are also mostly funded by government grant. The graph above only shows what you contribute as a council tax payer.

These are the top four services you pay for:

- Adult social care: £605 (39% of your council tax bill). Costs for this service are growing at around 10% a year. The growth is expected to be £13m in 2020/21. The 2020/21 budget for Adult Services, which also includes housing and public health, is £118.8m, up from £103.2m this year. The housing budget has been cut by £400k and the public health budget by £211k.

- Waste and recycling: £188 (12%). Costs can rise by inflation under the Veolia PFI contract but the council has negotiated a £450,000 reduction in costs. The government contributes £3.2m in PFI credits leaving £31.0m to be paid through council tax in 2020/21, slightly higher than the £28.9m this financial year.

- Children’s social care £159 (10%). This is an area where costs are growing. The budget is £32.2m in 2020/21, up from £30.3m.

- Highways £106 (7%). Budgets have been cut by £10m over the last two years. The budget for 2020/21 is £14.6m, down from £16.3m this year.

Ludlow has suffered a plague of potholes after Storm Dennis. This would not have occurred if the county’s roads had been maintained to the standard of the now infamous Vince’s Road near Oswestry. But there is no budget for that.

Here is a more detailed breakdown of where your money went in 2019/20.

is there available for the cost of councillors allowances and expenses? During the five years of destroying local services and making redundant more than 1000 employees there has been no reduction in the number of councillors nor a reduction in their allowances. how can this be justified?

A reduction in the number of councillors is on the cards after the May 2021 elections. Political demographics show that having bigger wards and wards with more than one councillor will favour the Tories. That’s because Labour and Lib Dems occupy pockets in the political demography. Increase the ward size and you get more Tories.

It would take me too long to to compile a summary of councillor expenses. You or someone else should submit an FoI. For the record, I only claim my basic councillor allowance of around £11,400. I won’t be able to afford that after May 2021 so I will also claim travel.